Active Balance

Simplifying your daily balance

Product Type

Adding a Feature to the Mint Mobile App

3 weeks / 100+ hours

Concept Client

Mint Intuit

My Role

User Experience Design, User Research, Prototyping, User Testing

Tools

Figma, Illustrator, Otter.ai, Photoshop, Google Meet, Mural

Problem

Active Balance aims to create an addon feature for integrating financial management into the daily lives of Mint users, promoting financial health and peace of mind.

Despite the wide array of budgeting tools, many find them complex and time-consuming. The Active Balance feature is set to identify and alleviate user pain points for easier budget management by tackling prevalent issues.

Data surveys from NerdWallet and Mint show that a majority of Americans regularly exceed their budgets and lack awareness of their expenditures. My proposal involves integrating a feature into an existing platform that resonates with user habits and secures their long-term engagement. This approach aims to attract new users, re-engage existing ones, and strengthen trust by demonstrating the company's commitment to user-centric innovation.

Goal

Investigate users' budgeting challenges

Interview users to tailor a solution to their needs

Create an empowering and positive budgeting experience for users

Solution

The need for simplicity in budgeting was evident from my research. I developed a streamlined method that enables users to thoughtfully control discretionary spending after accounting for essentials, such as bills and savings. The system assists users in determining reasonable personal spending for activities like hobbies or casual outings. Iterative testing and refinement were conducted to ensure the tool was user-friendly and effective.

Competitive Analysis

Understanding the ways individuals are able to budget with the current tools will show me the playing field of features that users currently have access to.

My competitive analysis identified Mint as a leading budgeting app with its extensive account management, retirement planning, and tax solutions. However, Mint has the potential to improve user engagement and market share by embracing various budgeting techniques for different user preferences.

Through the competitive analysis of budgeting apps, it's clear that trade-offs exist between ease of use, range of features, and cost. Free apps may offer basic services and suffer from ad-related trust issues, while paid apps provide comprehensive budgeting tools at a higher price and sometimes miss the feature of investment tracking. Generally, a gap remains for an all-encompassing, user-friendly, and affordable budgeting app that can satisfy the full spectrum of consumer financial needs.

Competitor Insights

Optimize Mint's integrations for diverse budgeting learning styles

Focus on retaining and re-engaging users, addressing dissatisfaction with existing budgeting tools

Expand on intuitive budgeting methods to stand out

User Interviews

Interviewees seek a hassle-free financial tool that is efficient, user-friendly, and maps to their thinking.

Through interviews, I hope to understand how:

users encounter saving habits and challenges in managing finances

users approach financial management

users engage with financial tools and apps

“Budgeting seems like it's so laborious and something that I don't like. It's like one more thing I have to manage. So I think I just take the approach of like, I just will be really cheap all the time”.

– Interviewee

75% of interviewees practice frugality for budgeting but freely spend on significant items.

30 percent of the individuals surveyed allocate funds automatically or manually each month.

All the participants wanted to better understand their budgets and be able to talk about money more freely.

User Interview Insights

Despite the various tools available, many users find them confusing and time-consuming

A need for an intuitive, user-friendly tool built around conscious, discretionary spending

No clear way to set daily amounts connected to real time balance, what can be spent and has been spent

Affinity Mapping

Users want an easy financial education tool to reduce stress and create positive money management experiences that works with their mental models.

Some users try to balance frugality and indulgence in spending habits, prioritizing their desires while trying to maintain a sense of financial responsibility.

Some users utilize automatic withdrawals as a convenient method for managing finances.

Survey results highlight a strong interest in enhancing financial literacy, with all participants expressing a desire for improved understanding and easier access to financial information and tools.

Key Affinity Map Insights

Both survey responses and interview insights reveal that when people are budgeting, they often utilize automatic withdrawals to manage finances, which is integral in understanding discretionary funds.

Budgeting apps can be stressful. Users would like a user-friendly, stress-free budgeting platform that offers flexibility in setup and notifications, while highlighting the need for improvements in financial education.

Intermittent reliance on Mint highlights the need for improvements encouraging

sustained user engagement.Users desire an open space to discuss financial literacy.

User Perspective

Users grow frustrated with budget apps—those that promise ease and results, yet often become a burden. Considering the problem from the user’s perspective provides vital insight to how we can solve their needs.

Through Point of View Statements (POV) and How Might We (HMW) questions I look to identify which features best assist users seeking to re-engage with methods aligned to their mental models, as well as offer new budgeters an approach that is intuitive, easy to use, and not intimidating.

Highlighted POV

Avery needs a way to easily categorize what is left of her income after paying for housing, bills, and setting aside emergency funds. This is because she is used to relying on automated methods to help save money. Expanding on established habits may help improve her financial management.

↓

Highlighted HMW

How might we set up a system that allows Avery to interact with the goal setting budget app but not have it be to time consuming?

POV and HMW Insights

POV: From the users’ perspective, I grasped the frustration stemming from budget apps that over promise and under deliver, turning promising financial tools into burdens.

HMW: My empathy with users underscores the need for a budget feature that simplifies setup, removes the typically annoying time investment, and fosters the gradual formation of healthy financial habits

Personas

Crafting personas helped to highlight the diversity of needs, potential daily touch points and common threads that will help inform how to best solve the add-a-feature problem.

This process is more than user profiles; it is about staying connected with users while developing solutions. User insight clears a direct path toward building an app that is intuitive, personal, and adaptable.

Avery Davis

Age: 42

Education: PhD

Status: Partnered

Occupation: Bookstore Manager

Tech Literate: High

About User

Avery, based in Seattle, is an avid learner with a passion for staying current on the latest tools and technologies. Quick to grasp new concepts, she tends to move on to new interests if she gets bored or forgets about a particular technology.

Core Needs and Goals

Effective general budgeting including future events and emergencies

Finding time for events and small group outings

Making time for hobbies

Frustrations

Can spend too much on eating out and activities with friends

Finds conventional budgeting tools intimidating

The task of constantly updating the app is time-consuming

“Fantasy doesn't pay bills”

Ethan Crane

Age: 35

Education: Masters

Status: Single

Occupation: Social worker

Tech Literate: Medium

About User

Ethan, a social worker in Indianapolis, excels in his role but struggles with new technology, often leading to frustration and a quick tendency to give up.

Core Needs and Goals

Understanding how to budget income

Keeping up with housing expenses

Traveling

Frustrations

Collects a lot of information but does not know what to do with it

Wants to increase income to and save more

“I don't have a solid system for budgeting. And that's such a intimidating word.”

Persona Insights

Personas involve direct integration into the development of the app's design. Insights from interviews, competitive analysis, affinity mapping, and thoughtful consideration of the information gathered shape my approach to design. It ensures that features resonate between research and intended audience, positioning me to design an experience that is intuitive, adaptable and ready for iteration.

Information Architecture

User and task flows for Active Balance clarified process of thought, helped to prioritize pages, maximize flow, and prevent bloat allowing focus on the feature and user experience.

A well-constructed site map is key to a collaborative dialogue throughout development. It aids understanding by encouraging focus and control over the fluid, often turbulent ideation process.

User Flow for opting in to Active Balance

Notifications task flow

Interaction Insights

The site map guided the creation of a comprehensive layout for effective user testing and feature integration.

It was important for planning the user interface, ensuring a thorough preparation for user testing.

It facilitated the incorporation of new features into the app, clarifying overlaps and guiding customization options.

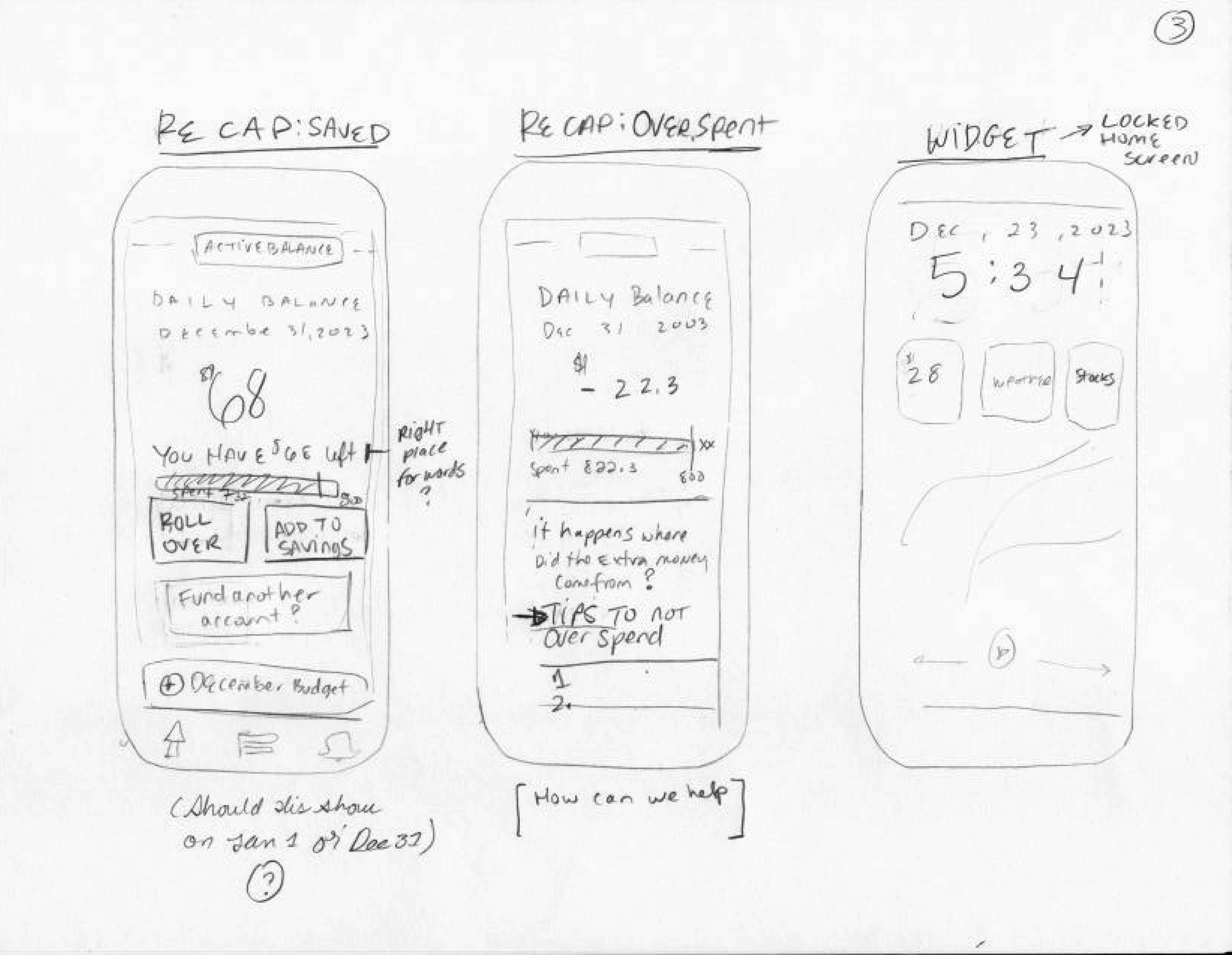

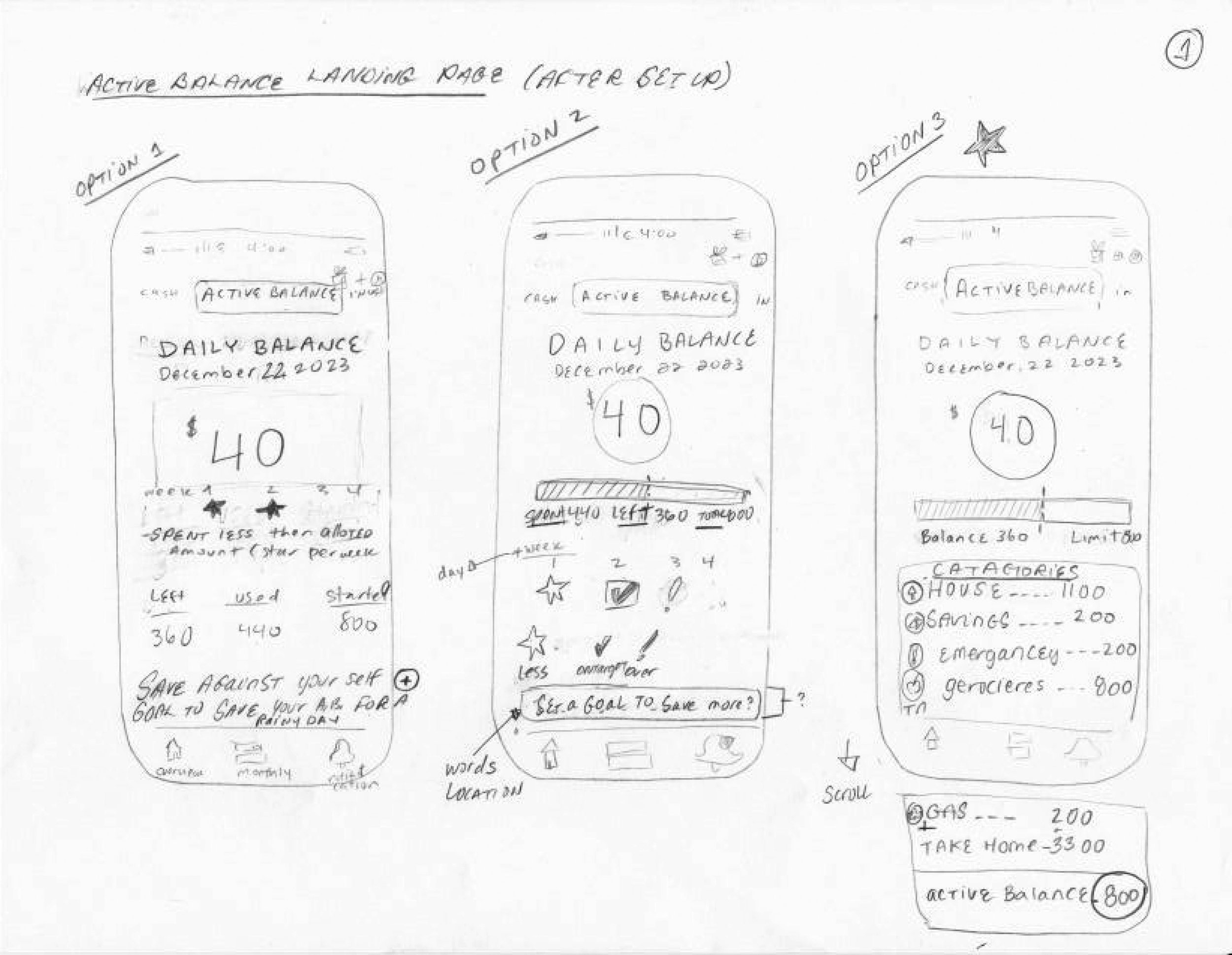

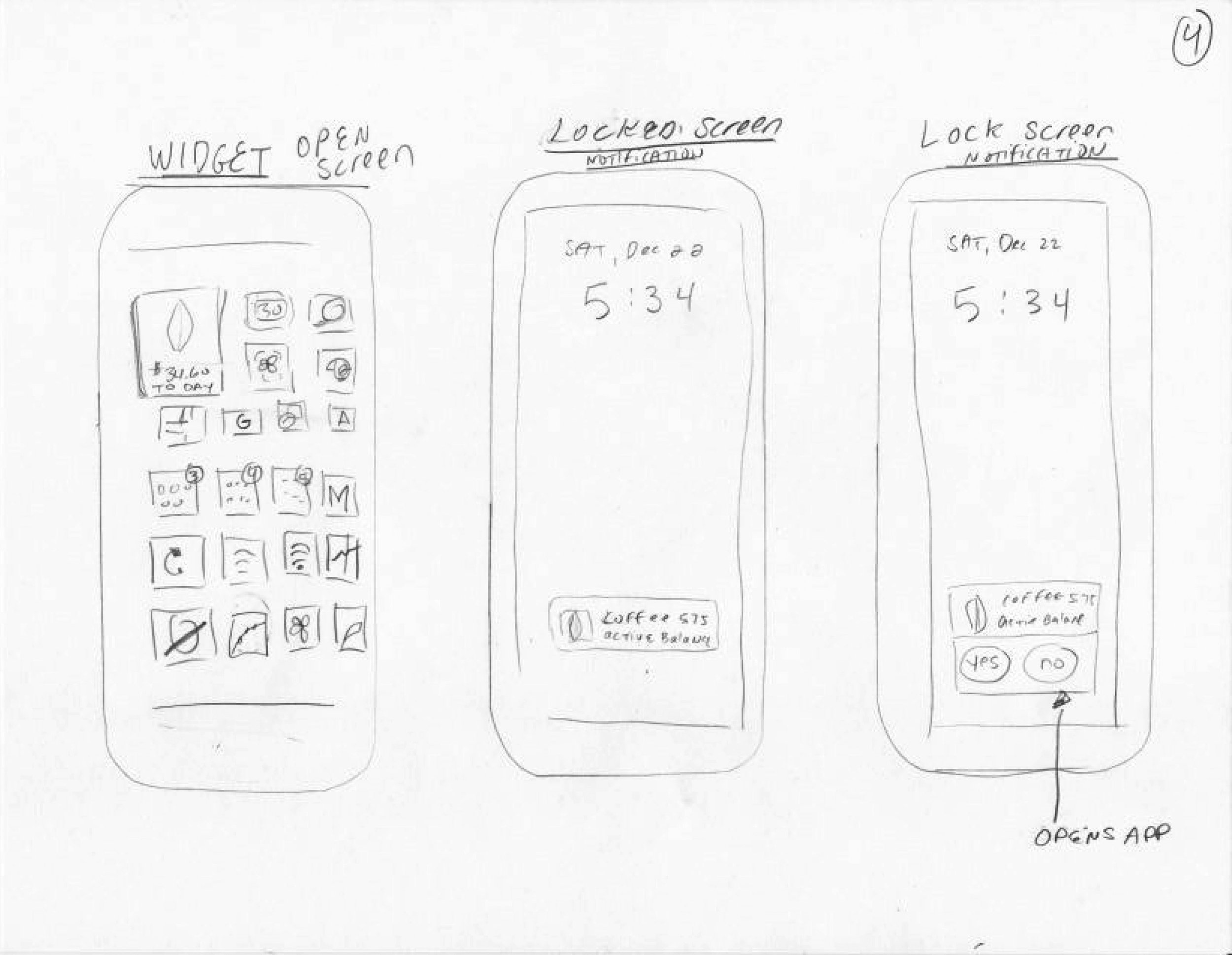

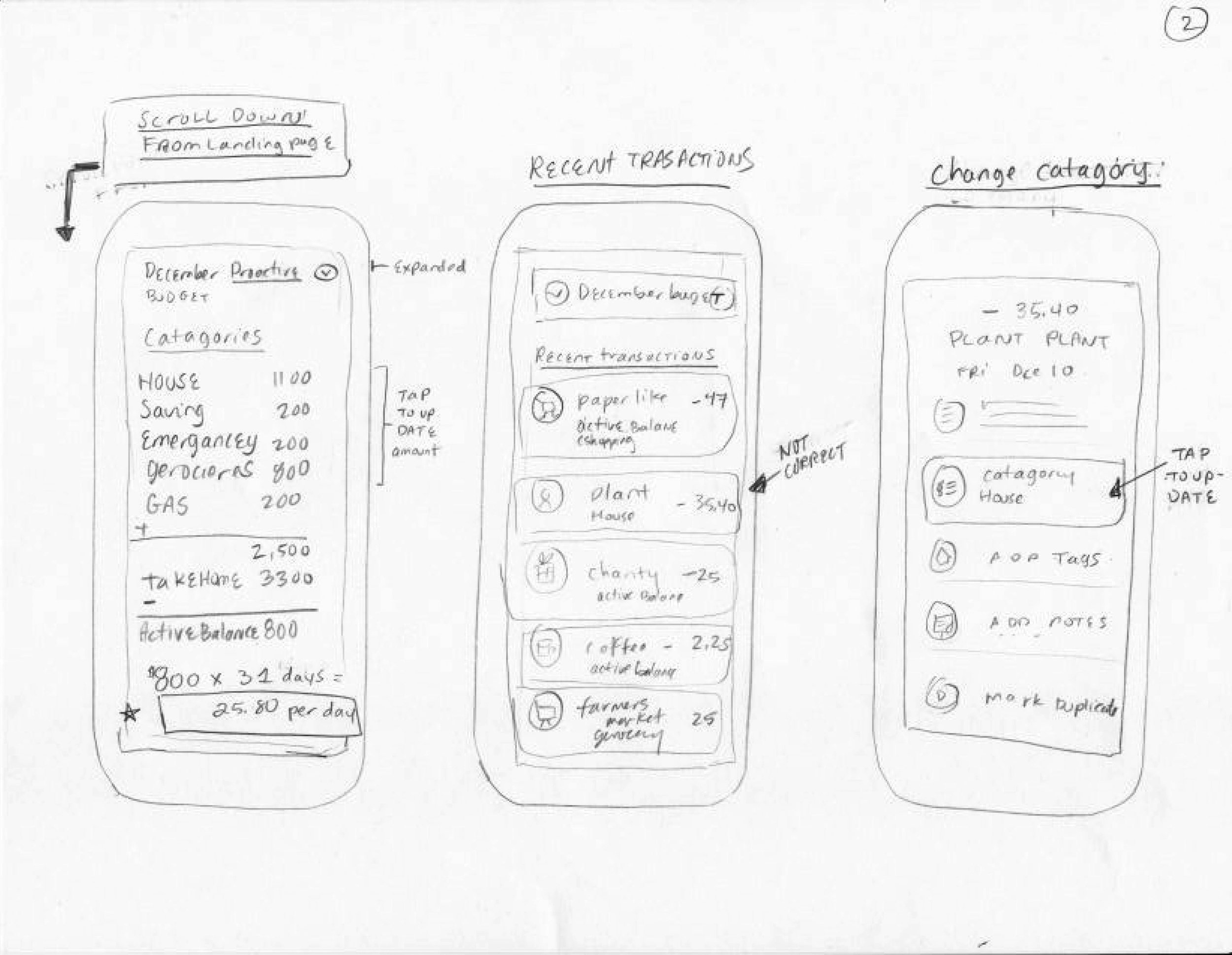

User Interface Design

Sketching interfaces through low-fidelity (lo-fi) prototypes honed user experience with direct feedback and design iteration.

This case study pursued insights into user behavior by examining reactions to homepage layouts, observing interactions to category screens, testing users' problem-solving with incorrectly categorized items, and refined the active balance feature of Mint with a series of wireframes and lo-fi sketches.

Learning and improvement insights

Users readily grasped the concept of daily spending tracking.

Widget received positive responses.

Feedback indicated the need for additional research on how users understand the graphs.

Participants suggested introducing diverse motivational techniques to maintain engagement (version 2 idea).

HI-Fi Mock ups

Progress toward higher fidelity mock ups revealed that users were excited about the daily budget feature, but clarity eluded its initial presentation.

A quick and easy way to visualize discretionary funds ensured that users became familiar with the process after just one use. These ongoing refinements have contributed to positive outcomes.

Keep discovering

Informed iterations enabled the creation of an added feature that took the power of Mint and developed another mental model for budgeting with a broad user base.

Iterating with user feedback

Although aspects of the app were user-friendly, clarity on the daily budget concept was lacking. My goal was to refine the functionality and affordance of the new feature that would retain functionality and allow the app to fit into the existing eco system while widening the user base.

A cycle of design, testing, and tweaking was embraced. Each round of changes was a conversation with users, a chance to dial-in on details and enhance the app’s usability. The first round of iteration kept the user in mind while working with personas and my task flows. However, familiarity from the developers perspective revealed the need for excessive explanation to gain insight from users. Due to the anxiety potentially surrounding the topic, it was found that simplified navigation within a budgeting and financial management tool was the most effective.

Daily View

Introduced a top title featuring

- The title of the new feature

- Information icon to learn more about the feature

- Added the date in a clearer wayAdded an easy way to tab through different views of the app

Made the daily budget more prominent

Clarified what you have spent

Added a visual remaining balance and tomorrow’s balance based on current balance

Added messaging

Showing how the average is created

Added a quick budget view

Monthly view

Introduced a top title featuring

– The title of the new feature

– Information icon to learn more about the feature

– Added the date in a clearer wayAdded an easy way to tab through different views of the app

Made monthly budget more prominent

Clarified what you have left

Added an update budget button

Screen 1

Screen 2

Screen 3

New Screens after 2nd round of testing.

Screen 1: Added information so the user can tap and be reminded how the feature works

Screen 2: Added weekly view

Screen 3: Added information so the user can tap and be reminded how the feature works

Iteration of the fittest

User testing showed the app's need for improved intuitiveness. Recognizing that users found budgeting intimidating or overwhelming led to developing a concept centered around allocating a daily budget tailored to each individual's spending habits. Initial feedback was positive, but further testing revealed the need for research on user preferences regarding data visualization, such as preferred graph types and timeframes. Iterations addressed this feedback, aiming to enhance both understanding and usability. Experiments with various visual elements including bars and circles were conducted during the process of refining the low-fi markups. However, users consistently struggled to interpret the meaning of horizontal bars as visualizers which led to the element’s omission.

Reflections

I successfully created a new feature for the Mint Intuit app—transforming Active Balance into a user-friendly platform and allowing users to seamlessly engage without encountering significant hurdles.

However, recognizing the inherent complexity of budgeting, I remain intrigued by the prospect of gradually advancing the system as users become more accustomed to its features. Continuous iteration was essential to making this mind exercise a challenging but fun and rewarding journey.

Looking ahead, I am eager to further explore avenues for improvement. Specifically, I aspire to delve into how users integrate Active Balance into their daily routines and to identify opportunities for refining the system even further. Budget on!